The 2026 UAE Construction Cost Forecast: Analyzing Steel and Raw Material Trends

Looking ahead to 2026, the UAE's construction cost forecast is pointing towards a moderate, yet firm, increase of around 2.7%. This data-driven outlook reveals a classic tug-of-war. On one side, you have global shipping lanes finding some stability, which should pull costs down. But on the other, the sheer scale of the nation’s giga-projects is creating immense local demand for commodities, pulling the construction cost per square foot right back up.

This push-and-pull between global shipping influences and local giga-project demand creates a complex environment for anyone trying to budget a project, from contractors to developers.

What is the 2026 forecast for the UAE construction market?

If you’re navigating the UAE’s construction landscape, you need a solid grasp of what’s really driving material costs. The next few years won't be about the wild, unpredictable price swings we’ve seen in the past. Instead, the data points to steady, demand-driven upward pressure influencing building material price trends Dubai will experience.

This completely changes the game. It moves the focus from frantically reacting to global supply chain crises to strategically managing predictable, local competition for resources.

For any contractor or procurement manager, this means the steel rates UAE 2026 will be just as influenced by a new development announced in Dubai as by a shipping lane disruption halfway across the world. Success now comes down to locking in reliable supply lines with a trusted supplier in Dubai.

What are the key cost drivers on the horizon?

Several moving parts are coming together to shape this market. It’s not enough to just watch one commodity; you have to see the interconnected picture that ultimately affects the final construction cost per square foot.

Here’s what’s really steering the ship:

- Sustained Giga-Project Demand: These mega-projects aren’t slowing down. They continue to soak up a massive share of available steel, concrete, and finishing materials, which naturally creates a more competitive local market for everyone else.

- Stabilising Global Logistics: While global shipping has thankfully calmed down from pandemic-era chaos, any geopolitical friction can still throw a spanner in the works. This volatility directly impacts the landed costs for any imported materials.

- Government Investment: The federal budget is still heavily funding infrastructure and manufacturing. This ensures that the baseline demand for construction materials remains consistently high.

- UAE Construction Standards: The UAE’s strict compliance requirements are non-negotiable. This makes sourcing from a trusted building materials distributor who can guarantee certified products absolutely essential to avoid eye-watering and costly project delays.

Recent analysis paints a very clear picture: material costs now make up roughly 60% of baseline construction costs in the UAE. This really brings home how fluctuations in steel and other raw materials have a direct and significant impact on overall project budgets.

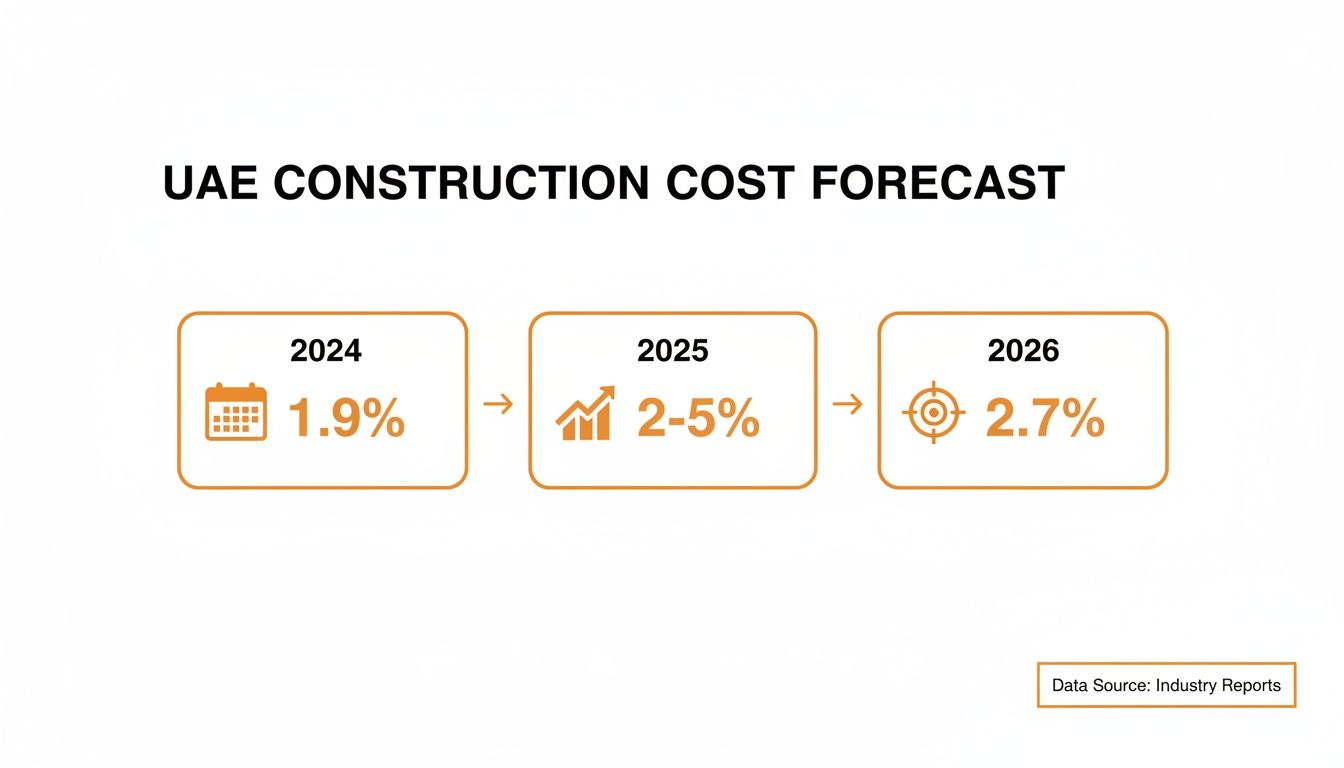

To give you a clearer view, here's a quick look at the recent and projected cost inflation trends.

UAE Construction Cost Inflation Forecast At a Glance

This table provides a high-level summary of construction cost inflation in the UAE, putting the 2026 projection into context.

| Year | Projected Cost Increase (%) | Primary Market Driver |

|---|---|---|

| 2024 | 1.9% (Actual/Forecast) | Post-pandemic global supply chain normalisation |

| 2025 | 2-5% (Projected) | Accelerating giga-project and infrastructure spending |

| 2026 | 2.7% (Projected) | Sustained high domestic demand balanced by stable global commodity prices |

As the data shows, we're in a period of moderated but consistent growth, setting the stage for the coming years.

This infographic helps visualise the trend, showing the steady climb from 2024 towards the 2026 forecast.

The data clearly maps out this period of steady cost growth, moving from 1.9% in 2024 toward the projected 2.7% in 2026. According to the UAE Construction Cost Benchmarking Report 2025, overall costs are expected to climb by 2-5% in 2025, which solidifies the runway for the 2026 forecast. This consistent, upward trend makes one thing clear: a forward-thinking procurement strategy isn't just a nice-to-have, it's essential.

If you want to dive deeper, you can read the full research about these cost drivers to really understand the details.

How do global supply chains influence steel rates in the UAE?

Global supply chains are the intricate web connecting steel mills around the world directly to construction sites in the Emirates. While the chaotic price shocks of recent years are settling, new tensions from geopolitical shifts and rerouted trade lanes constantly send vibrations through the system, directly impacting commodity prices on UAE shores.

This reality is the key to understanding the 2026 UAE construction cost forecast. It’s a direct line of cause and effect. A sudden shipping bottleneck in Asia can mean a noticeable jump in rebar prices on a Dubai project site just weeks later, a scenario that procurement managers have to anticipate constantly.

These big-picture global trends have a direct, tangible impact on the day-to-day business of a supplier in Dubai. Freight charges, insurance costs, and lead times aren't just line items on a spreadsheet; they are fundamental costs that get baked into the final price of every tonne of steel.

Why are shipping routes a critical factor for steel prices?

The journey steel makes from a foreign mill to a UAE port is a huge part of its final landed cost. Recent disruptions in global shipping, like vessels having to reroute around conflict zones, have added thousands of kilometres to journeys that were once straightforward, increasing fuel consumption and insurance premiums.

This extra mileage and complexity throw delivery schedules into disarray. For a contractor in the UAE waiting on a critical shipment of structural steel, this translates directly to higher material costs and the very real risk of project delays.

Global commodity price forecasts for 2026 suggest a slight contraction overall, but base metals like steel are a different story. While weak industrial demand in certain regions might pull prices down, the lingering effects of tariffs and ongoing logistical snags are pulling them right back up, creating a tough and complex pricing environment.

This really drives home the point: even if the raw cost of producing steel stabilises, the journey to get it here has become a massive and unpredictable variable in the cost equation.

How do global trade policies affect a supplier in Dubai?

Trade policies, like import tariffs or export bans, act like dams in the global flow of materials. When a major steel-producing country introduces a new tariff, it can make their steel more expensive overnight, forcing buyers worldwide to scramble for other sources.

This diversion sends a ripple effect across the entire market. A supplier in Dubai might suddenly discover their go-to source is no longer financially viable, forcing them to pivot and find new suppliers in entirely different regions. This change almost always involves:

- Longer Lead Times: Sourcing from a new, more distant country can add weeks to delivery schedules.

- New Logistics Chains: Building relationships with new shipping lines, freight forwarders, and ports adds complexity and cost.

- Price Volatility: Tapping into a new supply market exposes a business to a whole different set of pricing structures and risks.

Ultimately, all these factors shape the building material price trends Dubai contractors see on their invoices. If you want to get a firmer handle on this, you can learn more about navigating steel rates in the UAE in our comprehensive guide. In this kind of market, being proactive and working with trusted, well-connected suppliers is your best defence against volatility.

What role do giga-projects play in local material prices?

If global logistics are the external force influencing UAE construction costs, then local giga-projects are the massive, internal engine driving them forward. New smart cities and sprawling industrial hubs act as giant magnets for building materials, pulling in staggering quantities of steel, concrete, and MEP components from the local market and reshaping supply-and-demand dynamics on the ground.

This constant, high-volume demand creates an incredibly competitive procurement environment. Even when global supply chains are running smoothly, the sheer volume of materials being swallowed up by these mega-developments puts steady upward pressure on building material price trends Dubai. It means smaller to mid-sized projects are effectively competing against billion-dirham ventures for the very same pool of resources.

This dynamic is exactly why a strategic partnership with a well-stocked building materials distributor is no longer just a convenience—it’s a core part of any smart risk management strategy. In this market, securing a reliable supply line is your best defence against volatility.

How does concentrated demand impact steel rates?

When demand rockets past what’s readily available, prices climb. Giga-projects don’t just order materials; they order on a scale that can lock up a supplier’s entire inventory for months, sometimes even years, creating a ripple effect across the whole market.

An order for hundreds of thousands of tonnes of rebar directly influences availability and price for every other contractor. The effect is sharper for specialised materials that must meet strict UAE construction standards, because the number of compliant suppliers is smaller. This means the steel rates UAE 2026 will see are heavily tied to the construction timelines of these huge national projects.

The scale of this demand isn't just talk; it's backed by serious government investment. The federal budget for 2026, approved at AED 92.4 billion (a 29.2% increase from 2025), earmarks huge sums for transport and manufacturing—sectors that directly fuel the hunger for construction materials.

This level of sustained investment guarantees that demand pressure will be a defining feature of the market for the foreseeable future.

Why is a reliable supplier essential in this market?

In an environment of high demand and fierce competition, consistency and reliability matter more than the price tag alone. A delayed shipment of critical materials can bring a site to a standstill, leading to downtime and overruns that obliterate any savings from a slightly cheaper quote. Partnering with an established supplier in Dubai becomes a true strategic advantage.

A dependable distributor brings several crucial benefits to the table:

- Inventory Depth: They hold large, diverse stocks that act as a buffer when a giga-project suddenly absorbs a huge chunk of market supply.

- Logistical Expertise: They are masters of complex delivery schedules, ensuring materials get to your site exactly when you need them, keeping your project moving.

- Market Insight: A great partner provides priceless intelligence on pricing trends and potential supply bottlenecks, helping you plan your procurement with confidence.

This government-backed construction boom is set to drive major growth. With forecasts pointing to a construction output average annual growth rate of 4% from 2026 to 2029, the need for dependable material sources is more critical than ever. You can explore the full UAE Benchmark Report 2025 for a deeper look at these trends. As we gear up for 2026, locking in these partnerships will be the key to effectively managing your construction cost per square foot.

How can contractors navigate cost fluctuations?

To navigate the market's volatility, contractors need practical strategies to de-risk project plans before spending a single dirham. Managing fluctuations in the 2026 UAE construction cost forecast requires a data-driven approach, especially when raw materials like steel directly impact the final construction cost per square foot.

A sudden jump in rebar prices can completely eat away at profit margins on a fixed-price contract, turning a promising project into a financial nightmare. Managing this risk requires foresight and the right tools.

Why should you use digital tools for smarter bidding?

Modern cost estimation tools let you run "what-if" scenarios to stress-test your assumptions against various market conditions. This proactive planning helps you build resilient bids and manage client expectations with hard data, and the Yasu Cost Calculator is designed specifically as a tool for managing these fluctuations.

The Yasu Cost Calculator lets you model how potential shifts in steel rates UAE 2026 could impact your total material spend. By plugging in your project-specific quantities, you can make informed decisions long before you commit to a tender, turning a big unknown into a manageable variable. Of course, navigating these costs also means running a tight ship, which is why many contractors are exploring innovative construction company storage ideas to improve on-site efficiency.

Here’s a look at the Yasu Cost Calculator’s interface. You can see how simple it is to input quantities for various materials and get an immediate estimated cost.

The tool gives you a clear cost breakdown by category, which makes it easy to make precise adjustments and plan for different scenarios based on the latest building material price trends Dubai.

A Practical Scenario: De-Risking a Project Plan

Let’s walk through how this works in the real world.

The Scenario: A mid-sized contractor is putting in a bid for a new residential tower in Dubai. They know the structural phase, which is heavy on steel and cement, is scheduled to start in six months. Their biggest worry is a potential 5% increase in steel prices, which they fear could completely wipe out their profit margin.

The Strategy:

Establish a Baseline: First, the contractor uses the calculator to figure out the total material cost for the structure based on today's prices. This gives them a clear baseline budget to work from.

Model the "Worst-Case" Scenario: Next, they go back into the tool and nudge the steel rebar price up by 5%. The calculator instantly re-runs the numbers, showing them the exact financial damage of that potential price hike.

Build a Data-Backed Contingency: Instead of just guessing, they now have a hard number. They can build a specific 5% material cost contingency just for steel into their bid. Better yet, they can show the client the data to justify it.

Explore Alternatives with a Supplier: Armed with this info, they can have a much smarter conversation with their building materials distributor, like us at Yasu Trading. They might talk about pre-ordering a portion of the steel to lock in the current price or even look into alternative reinforcement products that still meet UAE construction standards.

By running these scenarios, the contractor transforms risk from a vague threat into a calculated line item. This data-driven approach not only strengthens their bid and protects their margin but also builds trust and transparency with the project owner.

This process is really fundamental to navigating today's construction market. Proactive planning, backed by the right digital tools and a solid relationship with your supplier, is the best defence against the financial shocks of material price volatility.

What key raw material trends exist beyond steel?

While steel gets much of the spotlight, a successful project relies on a whole cast of materials, and each has its own market story. To get a clear picture of the 2026 UAE construction cost forecast, you must look beyond the building's frame, as forces driving aluminium prices are different from those affecting PVC or cement, yet they all shape the final construction cost per square foot.

This broader view is non-negotiable for accurate budgeting. After all, the forces driving the price of aluminium are worlds apart from what's affecting PVC or cement. Yet, they all end up shaping the final construction cost per square foot.

How do energy costs affect aluminium and copper prices?

Aluminium and copper prices are directly linked to the global energy grid. Aluminium smelting is an incredibly electricity-intensive process, so a spike in global energy prices can quickly make window frames and facades more expensive in the UAE.

It's a similar story for copper. Mining and refining it takes a lot of energy. With global demand for copper soaring—thanks to everything from electric vehicles to green energy projects—any bumps in the energy markets are going to be felt in the cost of electrical wiring and plumbing pipes.

What local factors influence cement and PVC costs?

Unlike globally traded metals, cement prices are tightly linked to regional production capacity and the huge appetite of local giga-projects. A new wave of local construction can squeeze supply almost overnight, pushing up the price of this essential material. To really dig into this, take a look at our deep dive into cement price trends in the UAE.

Then there's PVC (Polyvinyl Chloride), the backbone of our pipes and fittings. As a petroleum derivative, its cost is tied directly to the price of crude oil. While global oil trends set the stage, local manufacturing capacity and the inventory levels held by a building materials distributor are what smooth out the short-term price bumps for contractors.

A recent analysis highlights that raw materials constitute 60% of total construction costs in the UAE. While steel and aluminium prices are stabilising after a 4.0% global increase in 2024, the market remains dynamic. With tender price inflation hitting 3.3% in 2025, proactive cost management is crucial. Discover more insights from Turner & Townsend's 2025 report.

This data really drives home why you can't afford to have a one-track mind when it comes to procurement.

Why is a consolidated supplier a strategic advantage?

Trying to juggle different materials with unpredictable price trends is a massive headache. Partnering with a single, reliable supplier in Dubai becomes a powerful risk-management strategy, not just a convenience.

Consolidating your procurement with one expert partner gives you serious advantages:

- Simplified Logistics: One phone call, one delivery schedule, one invoice. It just cleans up the entire procurement mess.

- Greater Buying Power: When you bundle your entire shopping list—from plumbing fixtures to industrial adhesives—you naturally unlock better pricing.

- Market Intelligence: A good distributor is on the front lines. They provide invaluable insights across all materials, helping you see around the corner and anticipate shifts in the building material price trends Dubai is facing.

- Guaranteed Compliance: A trusted supplier is your guarantee that every single item, no matter the category, meets strict UAE construction standards. That means no costly rejections or delays on site.

By centralising your purchasing, you stop reacting to price fires and start proactively managing your project's bottom line.

How can procurement teams mitigate risk in 2026?

For procurement teams, the 2026 UAE construction cost forecast requires a shift from reactive purchasing to proactive risk management. The key to coming out ahead isn't about chasing the lowest price; it’s about building a resilient supply chain that can absorb market shocks and protect your project margins.

Getting this right means blending strong supplier relationships, smart data, and an ironclad commitment to quality to keep projects on track and on budget.

Why should you forge strategic supplier partnerships?

The single best way to secure your material pipeline is to move beyond transactional relationships and cultivate long-term partnerships. A reliable building materials distributor does more than just sell products; they offer invaluable market intelligence, priority access to stock, and a crucial buffer against uncertainty.

When you consolidate your procurement with a true partner, you gain a commitment that ensures consistent material flow, even when giga-projects are soaking up local supply. This relationship is your front-line defence against sudden shortages and price spikes. To get ahead of these issues, it's wise to explore various supply chain risk mitigation strategies now.

A strong partnership transforms procurement from a simple cost centre into a strategic advantage. It’s about securing not just materials, but also the expertise and logistical support needed to navigate complex building material price trends Dubai will face.

How can you integrate proactive digital tools?

Stop guessing and start calculating. By embedding data-driven tools like the Yasu Cost Calculator into your planning and tendering phase, you can model different cost scenarios before you ever submit a bid.

This data-first approach gives you genuine foresight, strengthening your financial position from the outset. It lets you simulate how a potential spike in steel rates UAE 2026 would ripple through your total project cost.

This allows you to:

- Build Data-Backed Contingencies: Justify your cost planning to clients with clear, transparent numbers.

- Stress-Test Your Bids: See exactly where your financial exposure lies under different market conditions.

- Make Informed Decisions: Base your procurement strategy on quantitative risk analysis, not just a gut feeling.

This kind of proactive modelling is fundamental to managing the all-important construction cost per square foot.

Why must you maintain strict standards compliance?

One of the most critical risk mitigation tactics is an unwavering commitment to UAE construction standards. Sourcing materials that appear cheaper but aren't fully compliant is a classic false economy, introducing the colossal risk of rejection by authorities down the line.

That single rejection can set off a catastrophic chain reaction: costly delays, emergency re-procurement, and workforce downtime, wiping out any initial savings in an instant. Partnering with a supplier in Dubai who guarantees fully certified products is essential to ensure every component meets the exact specifications required, safeguarding both your project timeline and your budget.

Got Questions? We've Got Answers

When you're trying to get a handle on the UAE's construction market, a few key questions always come up. We're constantly talking to contractors and developers, and these are the topics that are front of mind as we look ahead to 2026. Here are some straightforward answers to help you plan with a bit more confidence.

Will steel prices see crazy hikes again in 2026?

Probably not. The steel rates UAE 2026 forecast suggests a more predictable, gradual climb of around 2.7%, not the wild price jumps of the past. This time, it's not chaotic global supply chains causing the headache; it's the massive demand from regional giga-projects that's driving the numbers, while global logistics are finally starting to look more stable.

What's the smartest way to budget for materials these days?

A solid budget needs a three-part defence plan. First, build in a specific contingency buffer of 4-5% for material cost swings. Second, use a digital tool like the Yasu Cost Calculator to run price scenarios before you bid. Third, partner with a reliable supplier in Dubai for market insights and price-locking opportunities.

Your budget's greatest defence is proactive planning. By modelling potential cost increases for key commodities, you can transform a vague risk into a calculated, manageable variable in your project's financial plan.

How does the UAE market compare to Saudi Arabia on costs?

The UAE is generally the steadier of the two. Here, you can typically plan for cost inflation in the 2-3% range, which is fairly predictable. Saudi Arabia's market has been much more volatile, with cost spikes sometimes hitting 5-7%, driven almost entirely by the sheer speed and scale of the Vision 2030 projects.

What's the single biggest cost risk for 2026?

The biggest risk is intense local demand pressure. The enormous volume of materials needed for ongoing giga-projects is creating fierce competition, directly shaping the building material price trends Dubai will face. Your number one move to counter this risk is to secure your supply chain by partnering with a trusted building materials distributor to avoid surprise cost jumps and ensure every component meets UAE construction standards.

For over 20 years, Yasu Trading Co. LLC has been the trusted partner for contractors across the UAE, delivering municipality-compliant materials exactly when they're needed. From MEP essentials to finishing hardware, we consolidate your procurement to keep your projects on schedule and within budget. Explore our full range of products and services at https://yasutrading.com.